putnam county property tax rate

The rates listed are per 100 of Assessed Value. April 7 2022 You may begin by choosing a search method below.

Greencastle Putnam County Development Center Putnam County Local Property Tax Table

Real Property Tax Service Agency Putnam County New York.

. Records Management Liaison Officer. Our office only collects county taxes and does NOT collect city taxes. Indiana uses the federal depreciation pools with a.

Putnam County property owners have the option to pay their taxes quarterly. 2021-2022 School Tax Rates. TIF01 - Granville TIF.

Putnam County Stats for Property Taxes. The assessed value on real estate is based in part on market value. Such an assignment refreshes the redemption period and the period of redemption for the subject parcel is 120 days after the date of assignment.

Putnam County collects relatively low property taxes and is ranked in the bottom half of all counties in the United States by property tax collections. To pay 2022 property taxes by installment please enter the property ID below and press search to complete the online application on or before April 30 2022Applications received on May 1 2022 or after will be applied to the 2023 tax year. What is the Putnam County tax rate.

Prior to her appointment Warnecke worked 9 years for the Village of Ottawa. Who sets the county tax rate and when. TFD - Tiskilwa Fire District.

Does the Putnam County Trustees Office collect city taxes. 2022 Putnam County Budget Order - Issued January 5 2022. Customers wishing to pay their taxes by installment must fill out APPLICATION and submit it to the tax collectors office by April 30 th of the year they wish to begin making installment payments.

Putnam County Online 2005 - 2022. Treasurer Warnecke is the 33 rd Treasurer. The Putnam County Commission sets the tax rate it is usually set in July.

When buying a house ownership is transferred from the seller to the purchaser. 2020-2021 School Tax Rates. The assessment value divided by 10000 and multiplied by the tax rate will give you the amount that should appear on your tax notice from the Putnam County Trustees Office.

Assessment value is a percentage of the market value. 25 residentialfarm 30 business personal property and 40 commercial. 2021 Putnam County Budget Order - Issued January 8 2021.

Taxes may be paid by credit card at. Changes occur daily to the content. Whether you are already a resident just pondering moving to Putnam County or planning on investing in its property find out how municipal property taxes work.

The Honorable Tracy L. Credit card payments will be accepted at the counter or over the phone at the Putnam County Treasurers Office. 2020 Putnam County Budget Order - Issued December 20 2019.

See Indiana Code 6-11-24-9. Putnam Country Tax Assessors Office Website. This fee is NOT charged by Putnam County nor is any part of the fee retained by the county.

Then who pays property taxes at closing if buying a house in Putnam County. Niese Warnecke was appointed Putnam County Treasurer in March 2007 to fulfill the unexpired term of Treasurer Robert L. The accuracy of the information provided on this website is not guaranteed for legal purposes.

Property tax information last updated. 2019-2020 School Tax Rates Revised. GOV PAY click here.

Exemptions applications for Real Property should be filed with the Property Appraisers Office. 2021 Putnam County Budget Order AMENDED - Issued February 12 2021. 2 discount applies to current real property and tangible personal property tax payments postmarked on or before January 31st.

T04R - Magnolia Township R B. Putnam County Sheriffs Tax Office 236 Courthouse Drive Suite 8 Winfield WV 25213 304 586-0204. With this article you will learn helpful facts about Putnam County property taxes and get a better understanding of what to consider when it is time to pay.

Business owners need to file their Tangible Personal Property Return form DR-405 with the Property Appraisers Office. The median property tax also known as real estate tax in Putnam County is 79700 per year based on a median home value of 12400000 and a median effective property tax rate of 064 of property value. 001 - Hennepin Senachwine Multi-Township Assessor 005 - Unit School District 005 115 - Grade School District 115 500 - High School District 500 513 - Junior College 513 535 - Unit School District 535 C001 - Putnam County GHMF - Granville - Hennepin Fire.

Property taxes are regularly paid beforehand for an entire year of possession. The median property tax also known as real estate tax in Putnam County is 733100 per year based on a median home value of 41810000 and a median effective property tax rate of 175 of property value. Benroth who was elected County Auditor in November 2006.

Putnam County Local Property Tax Table. To obtain the most current information please contact the Putnam County Tax Collectors office. 40 Gleneida Ave Room 104 Carmel NY 10512.

The Putnam County Indiana Treasurers Office is responsible for the collection and management of county taxes as well as other financial duties. Installment payments are made in June September December and March. The order also gives the total tax rate for each taxing district.

Instead contact this office by phone or in writing. In Florida Property Appraisers are independent constitutional officers duly elected from their counties of residence by their fellow citizens and taxpayers. Local property taxes in Indiana are paid in arrears.

The 2021 county tax rate is 2472 10000 2472 assessed value. Putnam County Property Appraiser. View an Example Taxcard.

For an easier overview of the difference in tax rates between counties explore the charts below. Putnam County Property Tax Facts. All online payment transactions are final and cannot be reversed.

You can also get additional insights on median home values income levels and homeownership rates in your area. Gov- Pay charges a 265 300 minimum convenience fee on each transaction. The assessed value on business personal property is based on depreciated cost.

Putnam County Assessor Frequently Asked Questions

Property Appraiser Putnam County Florida

Putnam County Tax Assessor S Office

Putnam County Ny Property Tax Search And Records Propertyshark

How Healthy Is Putnam County New York Us News Healthiest Communities

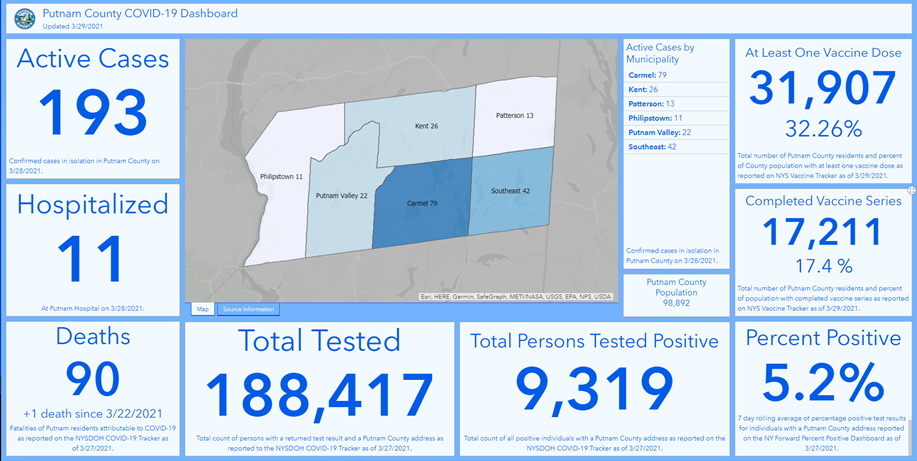

Town Of Philipstown Putnam County Weekly Covid Dashboard 29 Mar 2021

Greencastle Putnam County Development Center Putnam County Local Property Tax Table

Putnam County D A Archives Putnam County Online

Home Putnam County Board Of Realtors

County Millage Rates Property Appraiser

Putnam County Property Tax Inquiry

Keep Putnam Farming Putnam County Online

Greencastle Putnam County Development Center Greencastle Community Resume

Putnam County Tax Assessor S Office

April S Marketwatch Is In Look At That Interest Rate Indiana Marketing Things To Sell

2022 Best Places To Buy A House In Putnam County Ny Niche

County Information Putnam County Tn

Press Releases For County Executive Archives Putnam County Online